UBS Group AG Registered Ordinary Shares (UBS)

47.67

-0.09 (-0.19%)

NYSE · Last Trade: Feb 4th, 1:33 AM EST

Denny Fish is a portfolio manager for the Janus Henderson Investors Global Technology and Innovation Fund.

Via The Motley Fool · February 3, 2026

The company doesn't necessarily need a big win with artificial intelligence to relight the fire under this important profit center.

Via The Motley Fool · February 3, 2026

Snap shares have fallen nearly 45% over the past 12 months, only better than DJT, Sprout Social and Bumble over the same period.

Via Stocktwits · February 3, 2026

Marvell announced the completion of its acquisition of startup Celestial AI on Monday.

Via Stocktwits · February 3, 2026

Despite trailing the broader market over the past year, Berkshire Hathaway continues to earn cautious confidence from Wall Street.

Via Barchart.com · February 3, 2026

On February 10, 2025, the narrative of the "Magnificent Seven" faced its most significant stress test to date. While the broader technology sector enjoyed a robust rally fueled by artificial intelligence optimism and strong corporate earnings, Tesla (NASDAQ:TSLA) emerged as the glaring outlier. The electric vehicle pioneer saw its

Via MarketMinute · February 2, 2026

REDMOND, WA — In a stark reminder that even the titans of the "Magnificent Seven" are not immune to the gravity of market expectations, Microsoft Corp. (NASDAQ: MSFT) saw its shares plummet 10.1% on January 29, 2026. The sell-off, which erased approximately $357 billion in market capitalization in a single

Via MarketMinute · February 2, 2026

The company reported revenue of $3.02 billion for the quarter, 25% higher compared to the same period last year, and above analyst estimates of $2.9 billion.

Via Stocktwits · January 30, 2026

The American consumer is beginning to see a light at the end of the inflationary tunnel. According to the final January 2026 reading from the University of Michigan Survey of Consumers, one-year inflation expectations have eased to 4.0%, down from 4.2% in December and a peak earlier in

Via MarketMinute · January 30, 2026

Valued on earnings, SSR Mining stock looks like a buy. The cash flow picture is less clear.

Via The Motley Fool · January 30, 2026

Gold is expensive. Newmont stock is cheap. Buy Newmont stock.

Via The Motley Fool · January 30, 2026

Gold is expensive. Newmont stock is cheap. Buy Newmont stock.

Via The Motley Fool · January 30, 2026

TJX Companies has delivered strong outperformance relative to the broader market over the past year, and analysts continue to express strong confidence in the stock’s long-term growth and earnings potential.

Via Barchart.com · January 30, 2026

A SpaceX and xAI merger is not good news for EchoStar, which has a stake in Elon Musk’s rocket company.

Via Stocktwits · January 29, 2026

The global financial landscape reached a historic inflection point on January 29, 2026, as gold prices surged past the $5,500 per ounce mark, marking an unprecedented milestone in the history of precious metals. This "metal mania" reflects a profound shift in investor sentiment, as the traditional pillars of the

Via MarketMinute · January 29, 2026

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

Tesla stock is sinking as the EV maker reported its first-ever annual revenue decline and boosted capex guidance. Here’s how you should play TSLA shares on its post-earnings decline.

Via Barchart.com · January 29, 2026

Shares of technology giant Microsoft (NASDAQ:MSFT) fell 11.8% in the afternoon session after the company reported mixed fourth quarter earnings: Business Services and Intelligent Cloud revenue beat, but Personal Computing missed. EPS, even after removing the impacts of OpenAI, also beat expectations.

Via StockStory · January 29, 2026

Are Wall Street analysts favoring General Motors stock post its recent earnings release?

Via Barchart.com · January 29, 2026

Barclays raised its price target to $800 from $770 and highlighted a sharp rebound in advertising momentum, noting that revenue growth above 30% has eased many lingering investor worries.

Via Stocktwits · January 29, 2026

Despite underperforming the broader market over the past year, Apollo Global Management continues to command strong confidence from Wall Street, with analysts largely optimistic about its long-term growth trajectory and earnings potential.

Via Barchart.com · January 29, 2026

The US credit market has entered 2026 with a level of momentum unseen in nearly a decade, as a powerful combination of multi-billion dollar mergers and a resurgence in leveraged buyouts (LBOs) drives primary issuance to record heights. Following the Federal Reserve’s pivot toward a more accommodative stance in

Via MarketMinute · January 28, 2026

The data storage company received a slew of price target updates from Wall Street analysts after it reported Q2 earnings that beat market expectations.

Via Stocktwits · January 28, 2026

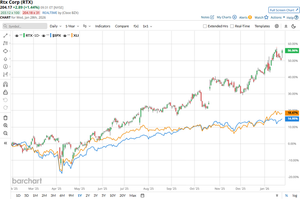

As of January 28, 2026, RTX Corporation (NYSE: RTX) stands as a definitive titan of the global aerospace and defense industry, commanding a market capitalization that reflects its indispensable role in both commercial aviation and national security. Emerging from a transformative 2025, RTX has effectively transitioned from a period of technical remediation—primarily surrounding its Pratt [...]

Via Finterra · January 28, 2026

With a market cap of $269.9 billion, RTX Corporation ( RTX ) is a global aerospace and defense company serving commercial, military, and government customers through its three operating segments: Collins Aerospace, Pratt & Whitney, and Raytheon.

Via Barchart.com · January 28, 2026