Invesco DB Base Metals Fund (DBB)

23.73

-0.42 (-1.74%)

NYSE · Last Trade: Feb 4th, 11:35 AM EST

This Rare Earth Stock, Which More Than Doubled In January, Has Once Again Become The Talk Of The Town – What’s The Greenland Angle?stocktwits.com

Via Stocktwits · January 27, 2026

The pilot plant will support the company’s Tanbreez rare-earth and critical metals initiative by providing infrastructure for its Arctic mining operations.

Via Stocktwits · January 7, 2026

US and EU face challenges in aluminum supply chain due to Trump's tariff policy. EU prepares emergency measures to protect industry.

Via Benzinga · August 29, 2025

Via Benzinga · April 3, 2025

Putin offers US access to Russian metals as alternative to US push for Ukraine's resources. He also proposes joint projects and investment opportunities.

Via Benzinga · February 25, 2025

Technical and cycle analysis, and market commentary.

Via Talk Markets · June 17, 2022

Commodities now struggle with the two-way narrative of extreme supply shortages but also waning demand due to downside global GDP growth risks.

Via Talk Markets · May 12, 2022

Donald Trump announced 25% tariffs on all steel and aluminum imports. Investors can consider these ETFs to trade following the development.

Via Benzinga · February 10, 2025

Metal markets facing turbulence under Trump, but gold stays strong as a debasement trade and aluminum may also hold up. Traders should wait, investors wary.

Via Benzinga · November 11, 2024

The case for categorizing commodities as one asset class has always been a shaky affair based on convenience rather than logic.

Via Talk Markets · September 27, 2024

Walmart beats earnings forecast and raises outlook, but economic indicators and declining commodity prices suggest caution in consumer spending

Via Benzinga · August 16, 2024

Look at how volatility has dropped to practically zero over the last eight months. If our years in the markets have taught us anything is that drops in volatility generally precede a change in trend.

Via Talk Markets · April 7, 2024

DBB has been in a strong uptrend going in the opposite direction as the stock market.

Via Talk Markets · February 28, 2022

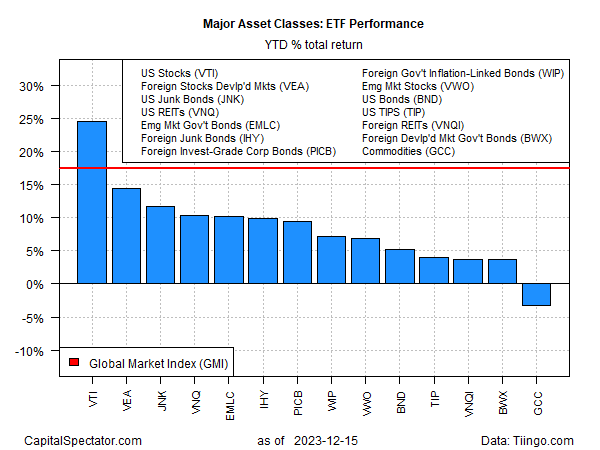

Reviewing 2023 results for the major asset classes reflects a long list of winners, with one conspicuous downside outlier commodities.

Via Talk Markets · January 16, 2024

A look at trending behavior in the commodities space for some perspective.

Via Talk Markets · December 18, 2023

Via Benzinga · June 13, 2023

Will external factors continue to steer AUD/USD direction?

Via Talk Markets · August 14, 2022

I’ve been mentioning lately that I thought that many areas in the PM complex could be building out a potential bullish expanding falling wedge. This is a bullish pattern that few if any chartists actually look for.

Via Talk Markets · August 1, 2022

Inventories of aluminum, copper, nickel, and zinc, four of the main contracts traded on the London Metal Exchange, have plunged by up to 70% over the past year, as record power...

Via Benzinga · April 13, 2022

Areas where exports from Russia and Ukraine are a significant portion of the global export market and whose disruption could have a significant impact on the global balance of supply and demand.

Via Talk Markets · March 29, 2022

Most commodities are correcting in an ABC Wave (2) bullish correction that will create buying opportunities.

Via Talk Markets · March 27, 2022

Deteriorating investor sentiment on stagflation fears may prevent a meaningful recovery in equities in the near term.

Via Talk Markets · March 7, 2022

The latest developments of the Russia-Ukraine geopolitical situation may slow down production activities and have an impact on the exporting of commodities and goods. A surge in the prices of crude oil, natural gas, and metals has already been seen.

Via Talk Markets · February 26, 2022

The media is filled with stories about the negative impact of rising and high inflation. Will inflation change everything we know about markets, investing, and asset allocation?

Via Talk Markets · October 22, 2021