Berkshire Hathaway (BRK-A)

740,149.86

+0.00 (0.00%)

NYSE · Last Trade: Feb 4th, 4:54 AM EST

New leadership at the company could soon begin to make some big moves.

Via The Motley Fool · February 3, 2026

Three reasons to think Coca-Cola's once-mighty dividend growth could roar back next week.

Via The Motley Fool · February 3, 2026

Michael Burry made a fortune betting against the U.S. housing market. He believes GameStop CEO Ryan Cohen is a Warren Buffett in waiting. Here are three reasons why that’s not the case and why bullish investors should tread carefully.

Via Barchart.com · February 3, 2026

DaVita (DVA) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 3, 2026

UniFirst provides workplace uniforms and facility services via recurring contracts to a broad customer base in North America and beyond.

Via The Motley Fool · February 3, 2026

These Buffett stocks could easily beat the market over the next 12 months.

Via The Motley Fool · February 3, 2026

Despite trailing the broader market over the past year, Berkshire Hathaway continues to earn cautious confidence from Wall Street.

Via Barchart.com · February 3, 2026

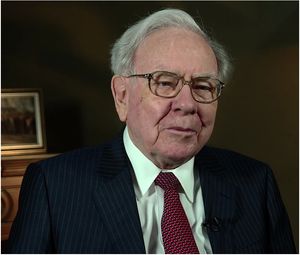

Warren Buffett has retired, but the Berkshire Hathaway portfolio was built under his leadership.

Via The Motley Fool · February 2, 2026

Stocktwits users clashed, with bears warning of a “rug pull” and dilution, while bulls pointed to potential benefits from the deal.

Via Stocktwits · February 2, 2026

Apple's surging iPhone sales and Berkshire's $378 billion cash hoard make a nice pair as an anchor for my portfolio in 2026.

Via The Motley Fool · February 2, 2026

Oversold dividend stocks can hide an opportunity. This article highlights Roper Industries, a Dividend Aristocrat showing oversold signals and solid long-term potential.

Via Barchart.com · February 2, 2026

If you have under $5 million in capital, you may have what Buffett calls a "huge institutional advantage."

Via The Motley Fool · February 2, 2026

Mark Cuban reiterated his criticism on the practices of major insurance companies, urging investors to reconsider their insurance investments.

Via Benzinga · February 2, 2026

Prior to the Oracle of Omaha's retirement as CEO, he jettisoned nearly 465 million shares of Bank of America and built an 8.8% stake in a beloved consumer brand that's skyrocketed 6,700% since its debut.

Via The Motley Fool · February 2, 2026

Low-volatility stocks may offer stability, but that often comes at the cost of slower growth and the upside potential of more dynamic companies.

Via StockStory · February 1, 2026

Warren Buffett remains chairman of Berkshire Hathaway's board but relinquished the role of CEO at the end of last year.

Via The Motley Fool · February 1, 2026

You can take a set-it-and-forget-it approach with these two industry leaders.

Via The Motley Fool · February 1, 2026

Since becoming CEO, Ryan Cohen has redefined GameStop's business and invested company funds outside of retailing.

Via The Motley Fool · February 1, 2026

The conglomerate is still the ultimate sleep-well-at-night stock.

Via The Motley Fool · February 1, 2026

Warren Buffett has officially stepped down, but could Berkshire still have a bright future?

Via The Motley Fool · January 31, 2026

It remains a compelling investment.

Via The Motley Fool · January 31, 2026

Tesla's robotaxis are finally driving without a safety driver in the front seat, so we're discussing future business models for Tesla, and also Greg Abel making a mark on Berkshire Hathaway, Apple's chatbot, and 24/7 trading.

Via The Motley Fool · January 30, 2026

Warren Buffett warns investors it's better to own a smaller portion of a good thing than the entirety of something worthless.

Via Barchart.com · January 30, 2026

The loss of the "Buffett premium" has put the shares on sale.

Via The Motley Fool · January 30, 2026

A rare moment of shortsightedness on the Oracle of Omaha's part cost Berkshire Hathaway a small fortune.

Via The Motley Fool · January 30, 2026