Semi trailers and liquid transportation container manufacturer Wabash (NYSE:WNC) announced better-than-expected revenue in Q4 CY2025, but sales fell by 22.9% year on year to $321.5 million. On the other hand, next quarter’s revenue guidance of $320 million was less impressive, coming in 22% below analysts’ estimates. Its non-GAAP loss of $0.93 per share was 21.6% below analysts’ consensus estimates.

Is now the time to buy Wabash? Find out by accessing our full research report, it’s free.

Wabash (WNC) Q4 CY2025 Highlights:

- Revenue: $321.5 million vs analyst estimates of $318.3 million (22.9% year-on-year decline, 1% beat)

- Adjusted EPS: -$0.93 vs analyst expectations of -$0.76 (21.6% miss)

- Adjusted EBITDA: -$26.2 million (-8.1% margin, 230% year-on-year decline)

- Revenue Guidance for Q1 CY2026 is $320 million at the midpoint, below analyst estimates of $410.4 million

- Adjusted EPS guidance for Q1 CY2026 is -$1 at the midpoint, below analyst estimates of -$0.09

- Adjusted EBITDA Margin: -8.1%, down from 4.8% in the same quarter last year

- Free Cash Flow was -$69.29 million, down from $54.03 million in the same quarter last year

- Backlog: $705 million at quarter end, down 41.3% year on year

- Market Capitalization: $455.4 million

“While conditions on the ground are improving for our customers, we have limited visibility into timing, pace and sustainability of the freight market recovery. With that said, the underlying conditions for a strong trailer demand response is growing once the freight market recovery threshold is met and our customers look to recapture profitability and get back to a growth mindset. But for now, our customers continue to defer capital spending decisions, and order patterns remain uneven, reflecting a highly managed near term reality across freight, construction, and industrial end markets.," explained Brent Yeagy, President and Chief Executive Officer.

Company Overview

With its first trailer reportedly built on two sawhorses, Wabash (NYSE:WNC) offers semi trailers, liquid transportation containers, truck bodies, and equipment for moving goods.

Revenue Growth

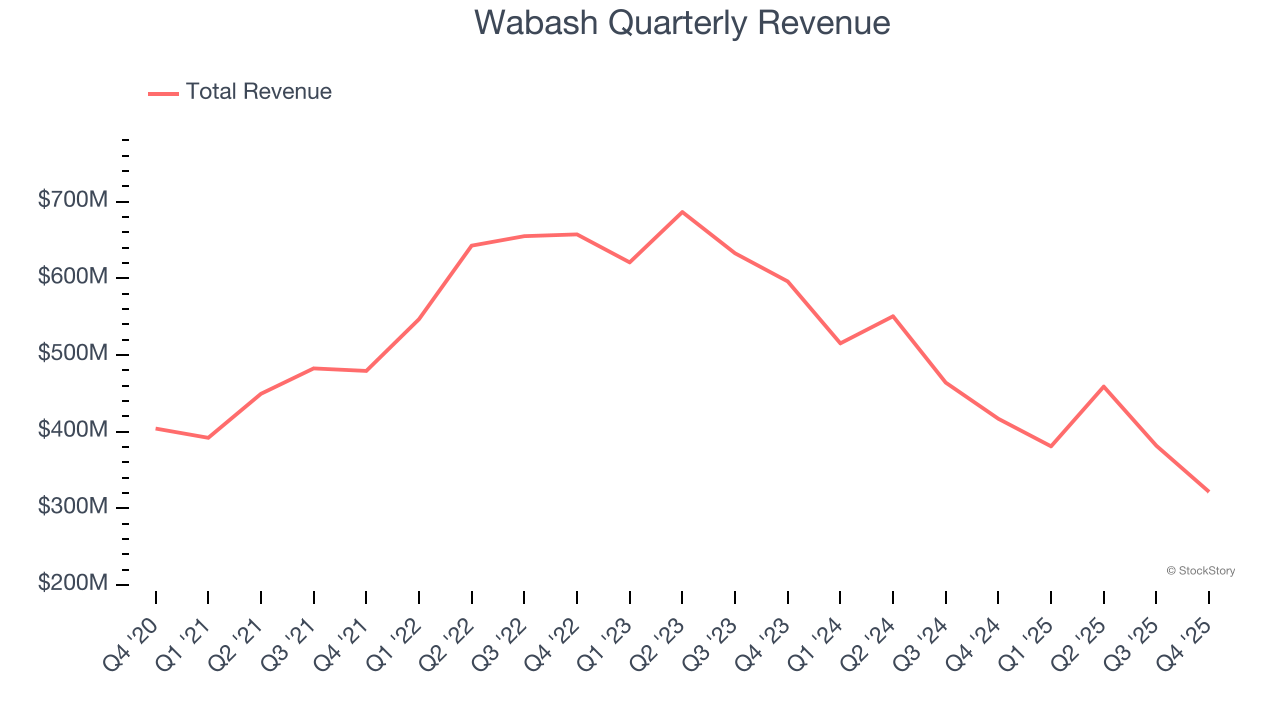

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Wabash struggled to consistently increase demand as its $1.54 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and suggests it’s a low quality business.

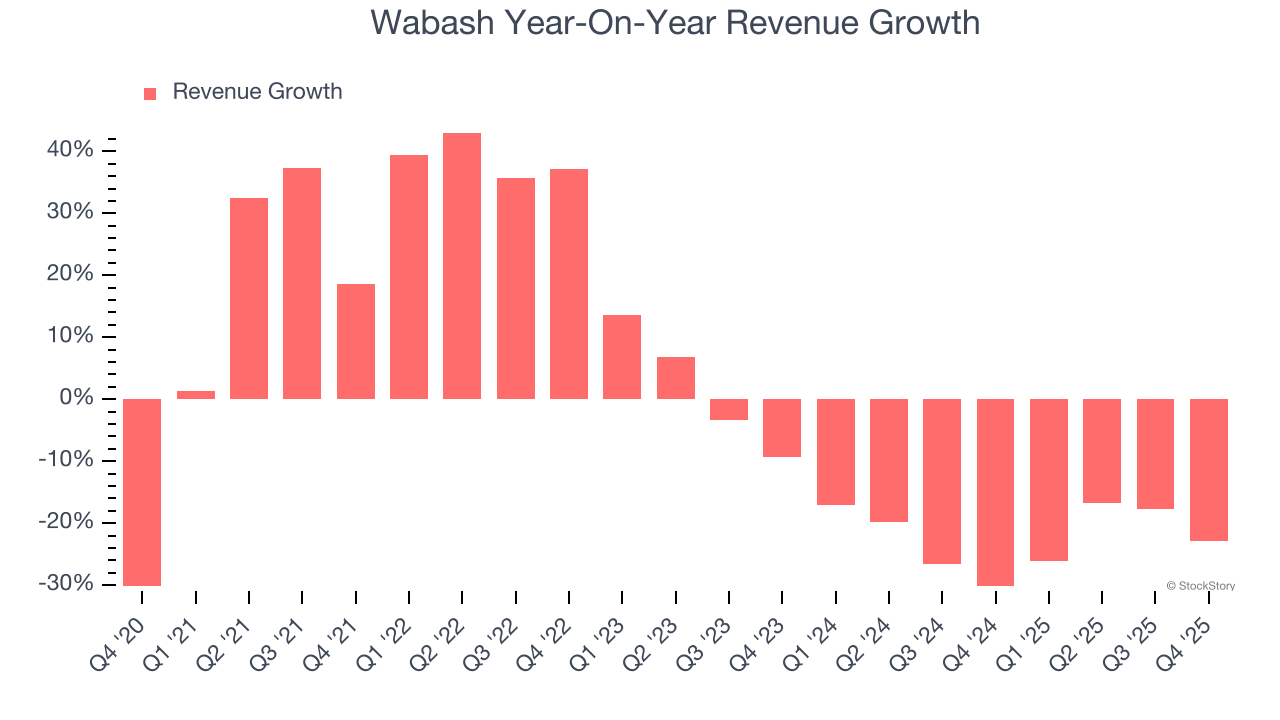

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Wabash’s recent performance shows its demand remained suppressed as its revenue has declined by 22% annually over the last two years. Wabash isn’t alone in its struggles as the Heavy Transportation Equipment industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

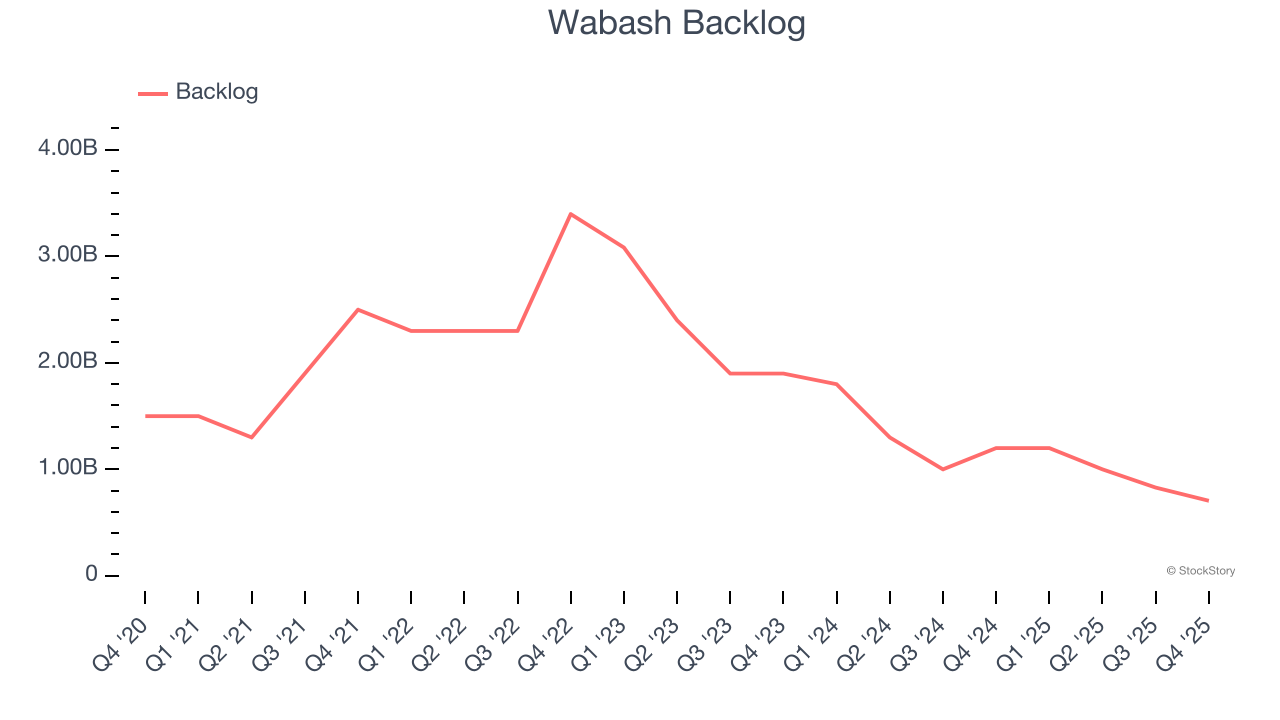

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Wabash’s backlog reached $705 million in the latest quarter and averaged 35.8% year-on-year declines over the last two years. Because this number is lower than its revenue growth, we can see the company hasn’t secured enough new orders to maintain its growth rate in the future.

This quarter, Wabash’s revenue fell by 22.9% year on year to $321.5 million but beat Wall Street’s estimates by 1%. Company management is currently guiding for a 16% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 12.2% over the next 12 months, an improvement versus the last two years. This projection is admirable and indicates its newer products and services will fuel better top-line performance.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

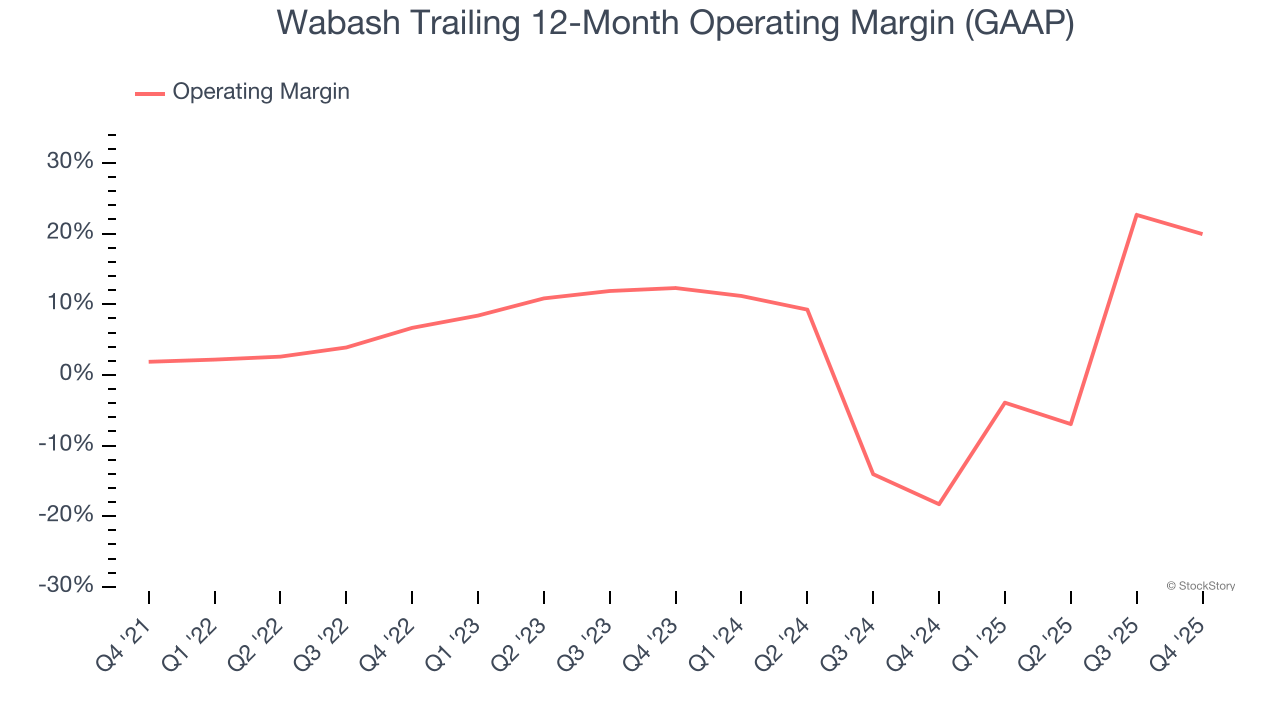

Wabash was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.5% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Wabash’s operating margin rose by 18.1 percentage points over the last five years.

In Q4, Wabash generated an operating margin profit margin of negative 18.6%, down 19.5 percentage points year on year. Since Wabash’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

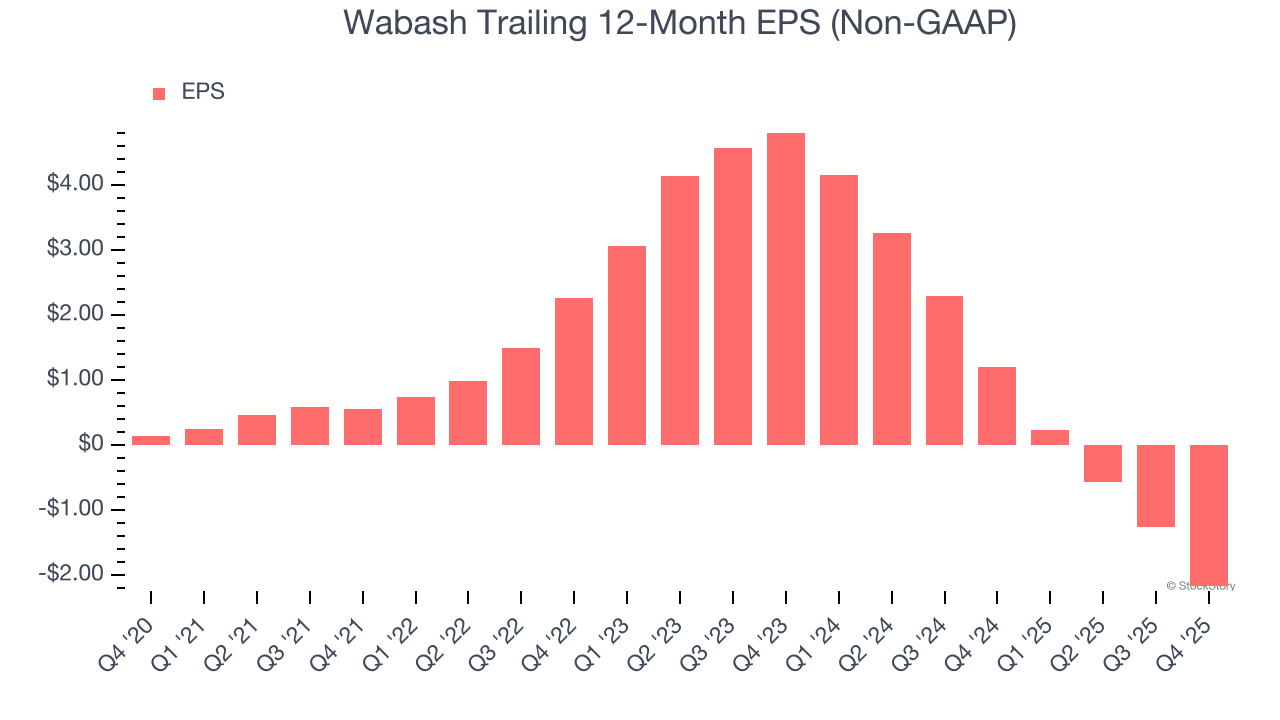

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Wabash, its EPS declined by 75.1% annually over the last five years while its revenue was flat. We can see the difference stemmed from higher interest expenses or taxes as the company actually improved its operating margin and repurchased its shares during this time.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Wabash, its two-year annual EPS declines of 56.6% show it’s still underperforming. These results were bad no matter how you slice the data.

In Q4, Wabash reported adjusted EPS of negative $0.93, down from negative $0.02 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Wabash’s full-year EPS of negative $2.17 will flip to positive $0.42.

Key Takeaways from Wabash’s Q4 Results

It was good to see Wabash narrowly top analysts’ revenue expectations this quarter. On the other hand, its revenue guidance for next quarter missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 7.5% to $10.40 immediately after reporting.

Wabash may have had a tough quarter, but does that actually create an opportunity to invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).