Electrical energy control systems manufacturer Powell (NYSE:POWL) missed Wall Street’s revenue expectations in Q4 CY2025 as sales rose 4% year on year to $251.2 million. Its GAAP profit of $3.40 per share was 16.6% above analysts’ consensus estimates.

Is now the time to buy Powell? Find out by accessing our full research report, it’s free.

Powell (POWL) Q4 CY2025 Highlights:

- Revenue: $251.2 million vs analyst estimates of $256.5 million (4% year-on-year growth, 2.1% miss)

- EPS (GAAP): $3.40 vs analyst estimates of $2.92 (16.6% beat)

- Adjusted EBITDA: $44.92 million vs analyst estimates of $42.86 million (17.9% margin, 4.8% beat)

- Operating Margin: 17%, up from 14.7% in the same quarter last year

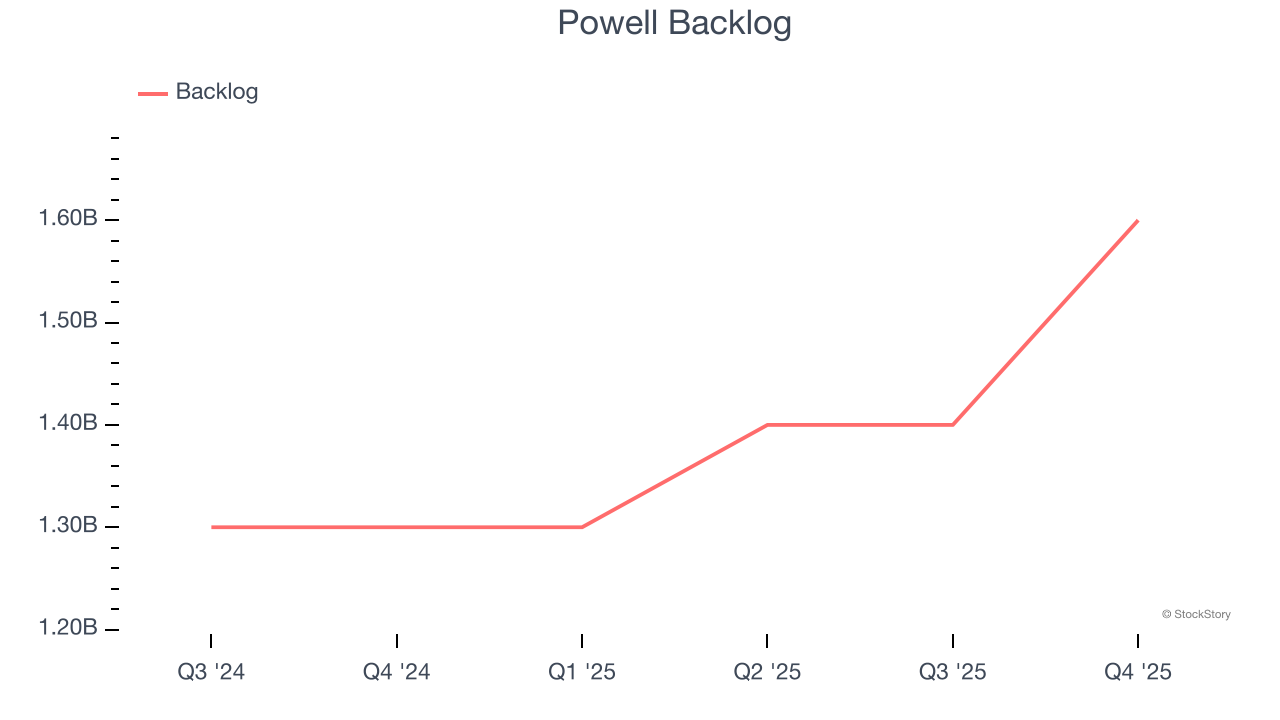

- Backlog: $1.6 billion at quarter end, up 23.1% year on year

- Market Capitalization: $5.35 billion

Brett A. Cope, Powell’s Chairman and Chief Executive Officer, stated, “Ongoing levels of solid project execution drove a strong start to our fiscal year, as we delivered a gross margin of 28.4% despite the typical seasonality and lower volumes that define our first quarter. We also experienced high levels of order activity across most of the markets we serve, as the $439 million of awards booked was the highest quarterly total in over two years and led to a book-to-bill ratio of 1.7. Activity in our Commercial & Other Industrial market has accelerated considerably, as this market accounted for almost one-half of our awards in the quarter, and the average project size that we are pursuing and winning has grown substantially, highlighted by our first megaproject(3) order in the data center end market. Also, we won a very large LNG award to support a project along the U.S. Gulf Coast, as this market continues to exhibit favorable dynamics. Overall, our fiscal year is off to a great start, and our results continue to demonstrate both the breadth of investment in electrical infrastructure, as well as Powell’s unique ability to deliver engineered-to-order solutions.”

Company Overview

Originally a metal-working shop supporting local petrochemical facilities, Powell (NYSE:POWL) has grown from a small Houston manufacturer to a global provider of electrical systems.

Revenue Growth

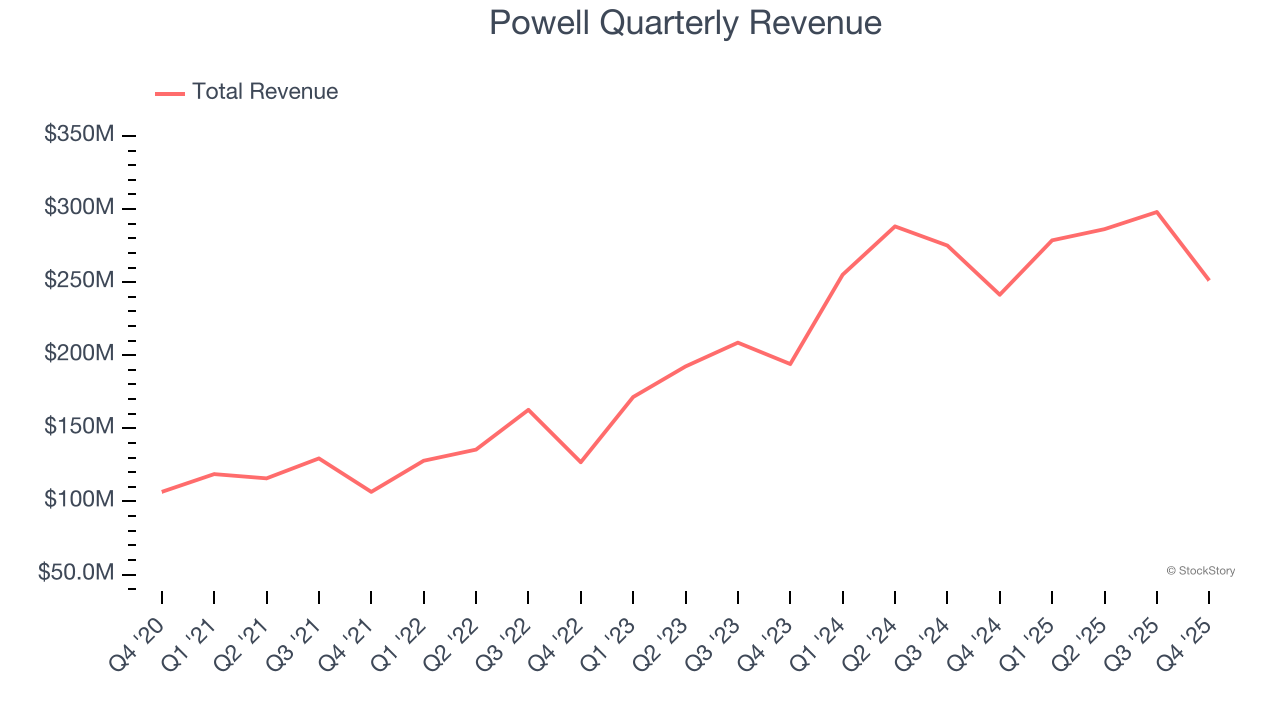

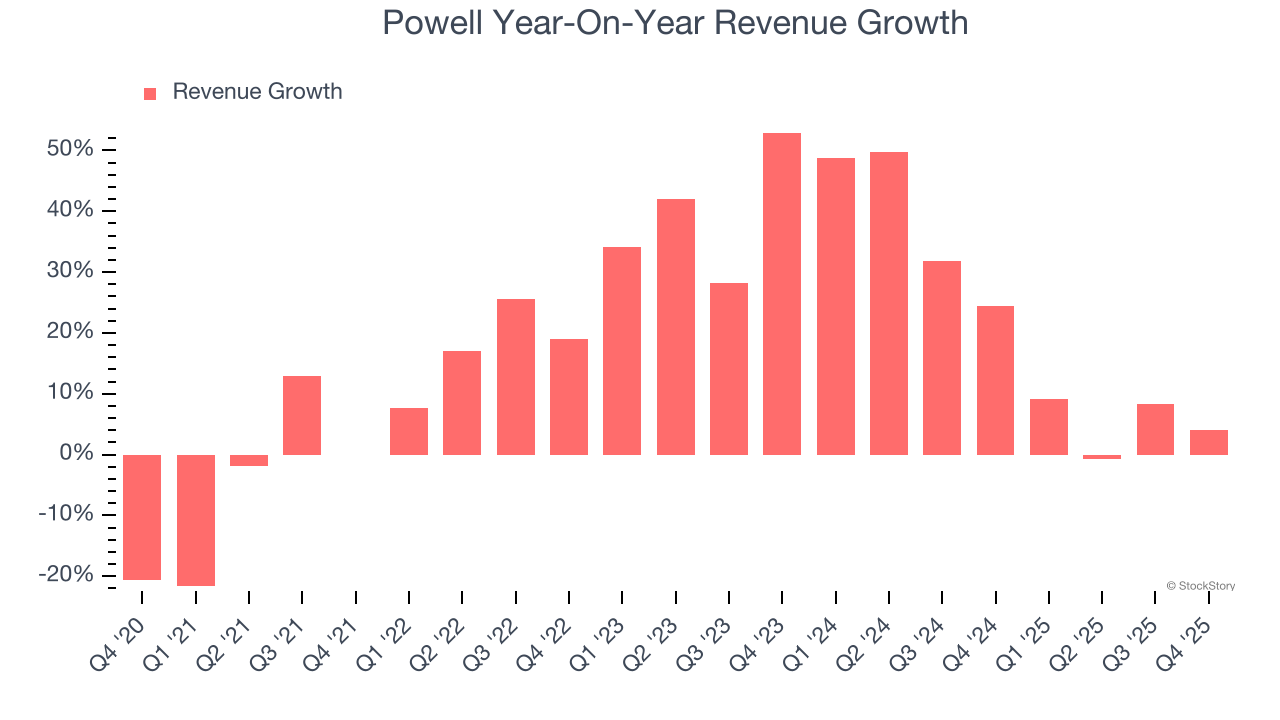

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Powell’s sales grew at an incredible 17.8% compounded annual growth rate over the last five years. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Powell’s annualized revenue growth of 20.6% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Powell’s backlog reached $1.6 billion in the latest quarter and averaged 15.4% year-on-year growth over the last two years. Because this number is lower than its revenue growth, we can see the company fulfilled orders at a faster rate than it added new orders to the backlog. This implies Powell was operating efficiently but raises questions about the health of its sales pipeline.

This quarter, Powell’s revenue grew by 4% year on year to $251.2 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 7.8% over the next 12 months, a deceleration versus the last two years. Still, this projection is above average for the sector and implies the market sees some success for its newer products and services.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

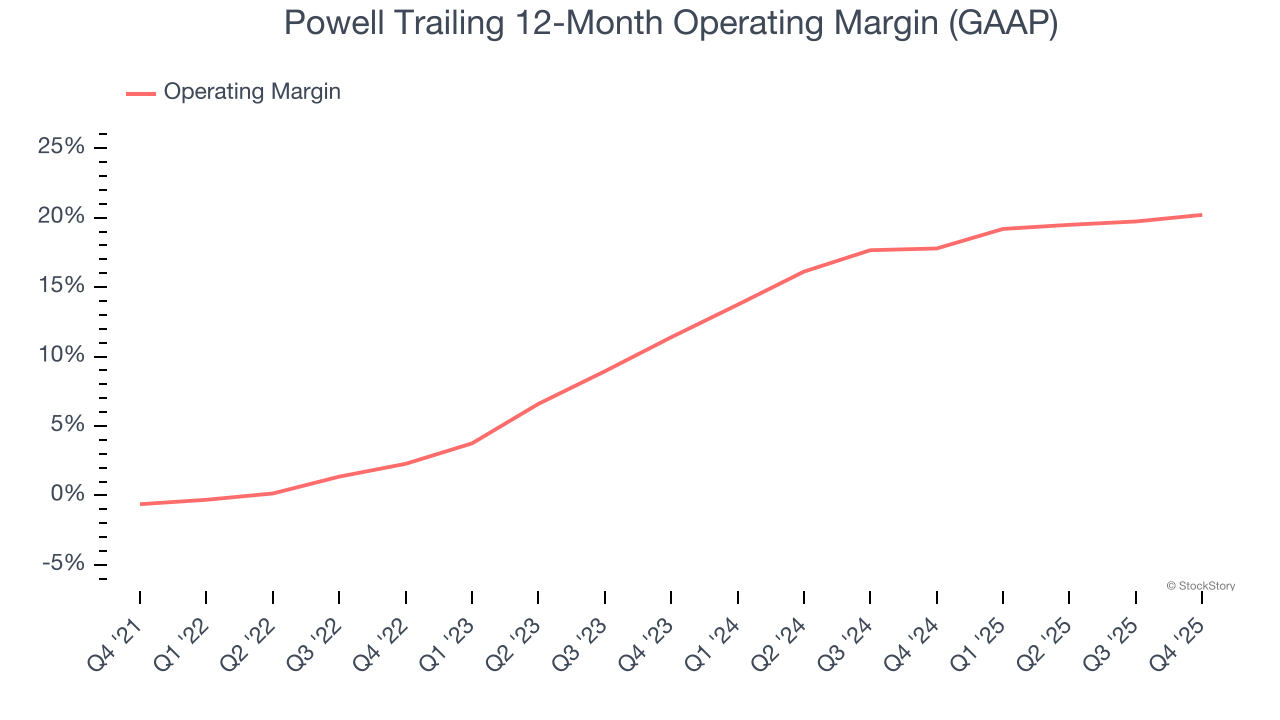

Powell has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.9%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Powell’s operating margin rose by 20.8 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q4, Powell generated an operating margin profit margin of 17%, up 2.3 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

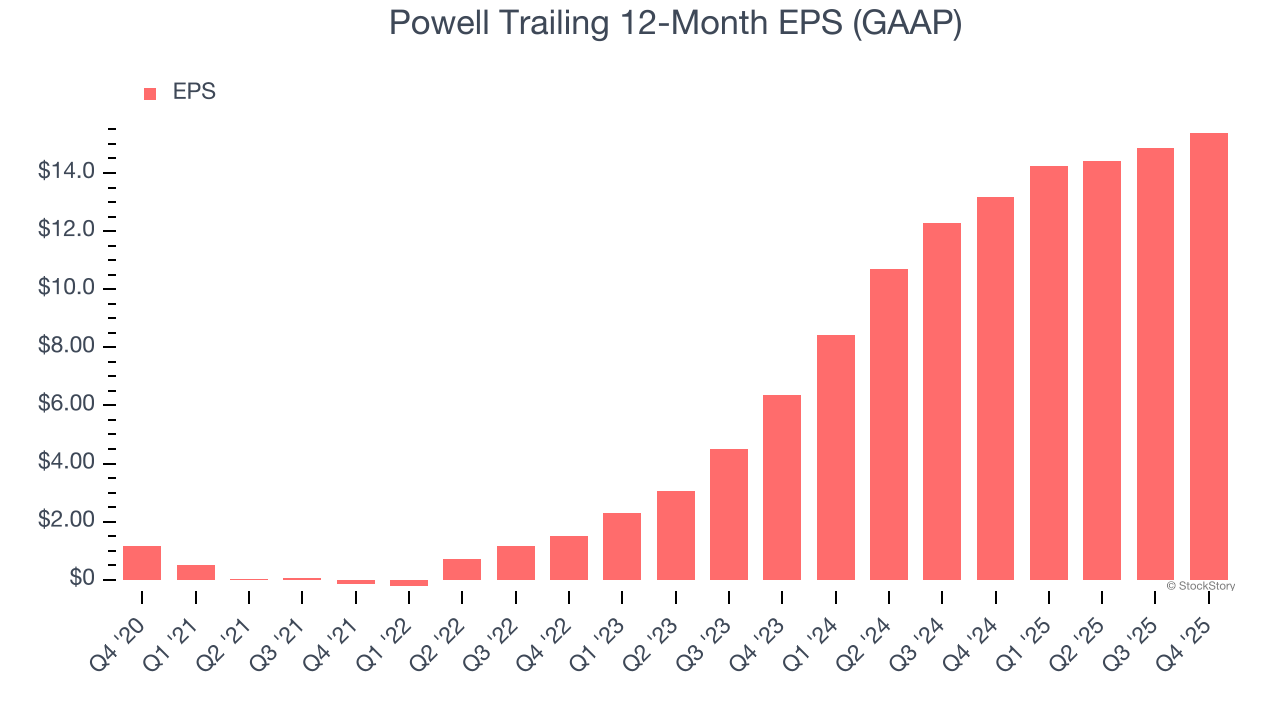

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Powell’s EPS grew at an astounding 67.7% compounded annual growth rate over the last five years, higher than its 17.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Powell’s earnings to better understand the drivers of its performance. As we mentioned earlier, Powell’s operating margin expanded by 20.8 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Powell, its two-year annual EPS growth of 55.4% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, Powell reported EPS of $3.40, up from $2.86 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Powell’s full-year EPS of $15.39 to grow 3.8%.

Key Takeaways from Powell’s Q4 Results

It was good to see Powell beat analysts’ EPS expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its revenue missed. Overall, this print had some key positives. The stock remained flat at $453.50 immediately after reporting.

So should you invest in Powell right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).