Packaged snacks company Mondelez (NASDAQ:MDLZ) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 9.3% year on year to $10.5 billion. Its non-GAAP profit of $0.68 per share was 2.4% below analysts’ consensus estimates.

Is now the time to buy Mondelez? Find out by accessing our full research report, it’s free.

Mondelez (MDLZ) Q4 CY2025 Highlights:

- Revenue: $10.5 billion vs analyst estimates of $10.31 billion (9.3% year-on-year growth, 1.8% beat)

- Adjusted EPS: $0.68 vs analyst expectations of $0.70 (2.4% miss)

- Adjusted EBITDA: $917 million vs analyst estimates of $1.66 billion (8.7% margin, 44.6% miss)

- Operating Margin: 9.1%, down from 16.8% in the same quarter last year

- Free Cash Flow Margin: 19%, up from 11% in the same quarter last year

- Organic Revenue rose 5.1% year on year (beat)

- Sales Volumes fell 4.8% year on year (0.1% in the same quarter last year)

- Market Capitalization: $75.73 billion

“We delivered solid top-line results, generated strong cash flow, and returned significant cash to shareholders in a dynamic and challenging 2025 environment. While unprecedented cocoa cost headwinds impacted our profitability, our teams remained focused on what they can control to best position us for sustainable, profitable growth,” said Dirk Van de Put, Chair and Chief Executive Officer.

Company Overview

Founded as Nabisco in 1903, Mondelez (NASDAQ:MDLZ) is a packaged snacks powerhouse best known for its Oreo, Cadbury, Toblerone, Ritz, and Trident brands.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $38.54 billion in revenue over the past 12 months, Mondelez is one of the most widely recognized consumer staples companies. Its influence over consumers gives it negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don’t have).

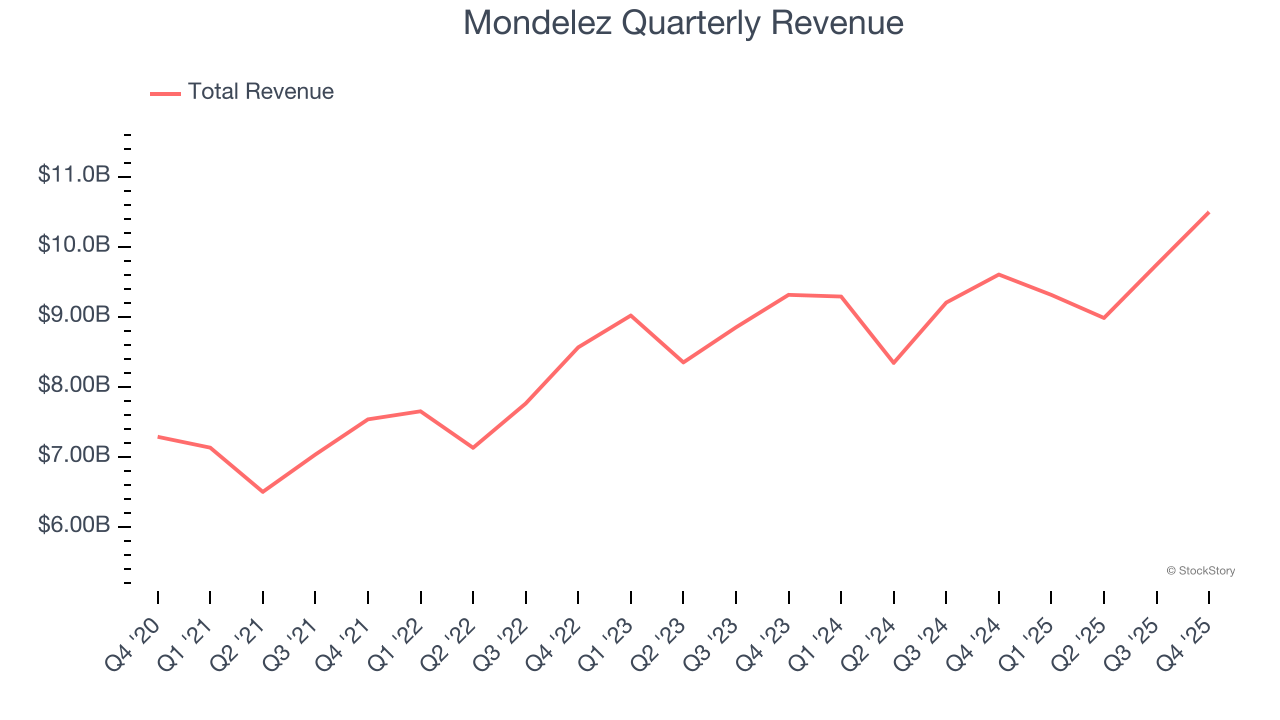

As you can see below, Mondelez grew its sales at a decent 7.4% compounded annual growth rate over the last three years despite consumers buying less of its products. We’ll explore what this means in the "Volume Growth" section.

This quarter, Mondelez reported year-on-year revenue growth of 9.3%, and its $10.5 billion of revenue exceeded Wall Street’s estimates by 1.8%.

Looking ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and implies its products will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

To analyze whether Mondelez generated its growth from changes in price or volume, we can compare its volume growth to its organic revenue growth, which excludes non-fundamental impacts on company financials like mergers and currency fluctuations.

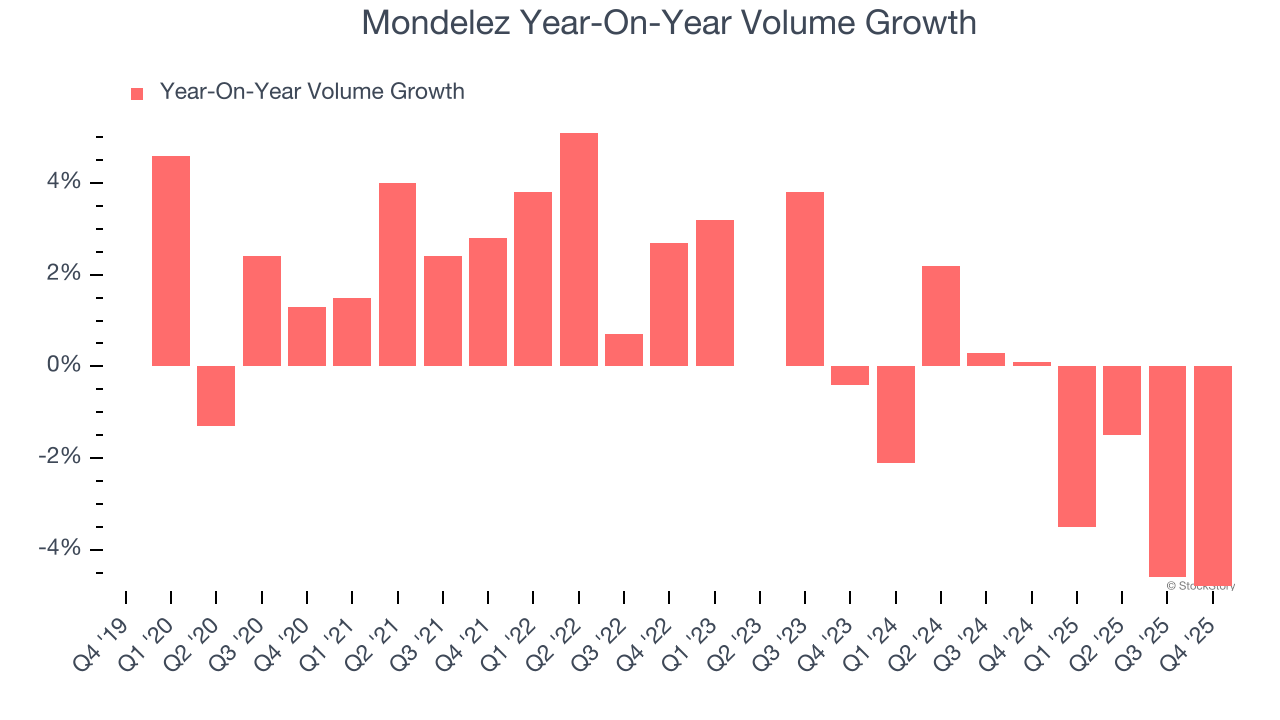

Over the last two years, Mondelez’s average quarterly sales volumes have shrunk by 1.7%. This decrease isn’t ideal as the quantity demanded for consumer staples products is typically stable. Luckily, Mondelez was able to offset fewer customers purchasing its products by charging higher prices, enabling it to generate 4.3% average organic revenue growth. We hope the company can grow its volumes soon, however, as consistent price increases (on top of inflation) aren’t sustainable over the long term unless the business is really really special.

In Mondelez’s Q4 2025, sales volumes dropped 4.8% year on year. This result represents a further deceleration from its historical levels, showing the business is struggling to move its products.

Key Takeaways from Mondelez’s Q4 Results

We were impressed by how significantly Mondelez blew past analysts’ gross margin expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 2.6% to $57.98 immediately following the results.

The latest quarter from Mondelez’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).