Shareholders of DigitalOcean would probably like to forget the past six months even happened. The stock dropped 25.7% and now trades at $30.61. This may have investors wondering how to approach the situation.

Is there a buying opportunity in DigitalOcean, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is DigitalOcean Not Exciting?

Despite the more favorable entry price, we're sitting this one out for now. Here are two reasons why you should be careful with DOCN and a stock we'd rather own.

1. Customer Churn Hurts Long-Term Outlook

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

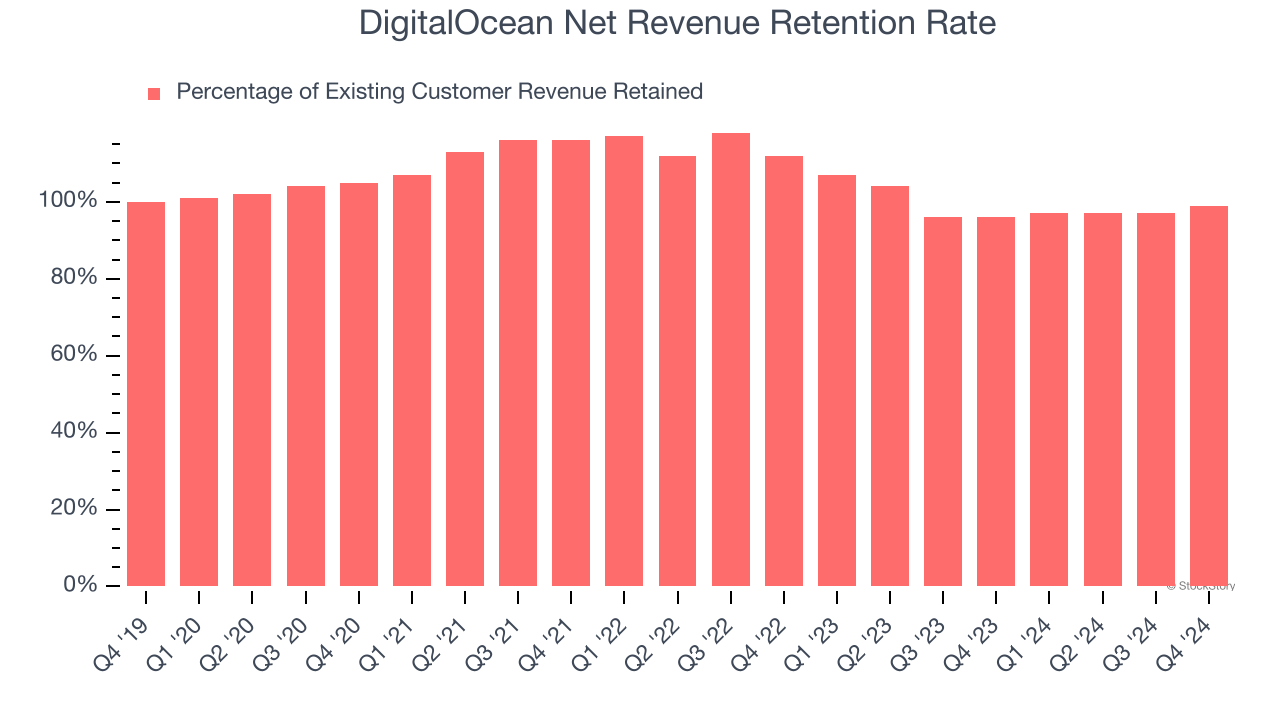

DigitalOcean’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 97.5% in Q4. This means DigitalOcean’s revenue would’ve decreased by 2.5% over the last 12 months if it didn’t win any new customers.

Despite trending up over the last year, DigitalOcean still has a weak net retention rate, signaling that some customers aren’t satisfied with its products, leading to lost contracts and revenue streams.

2. Low Gross Margin Reveals Weak Structural Profitability

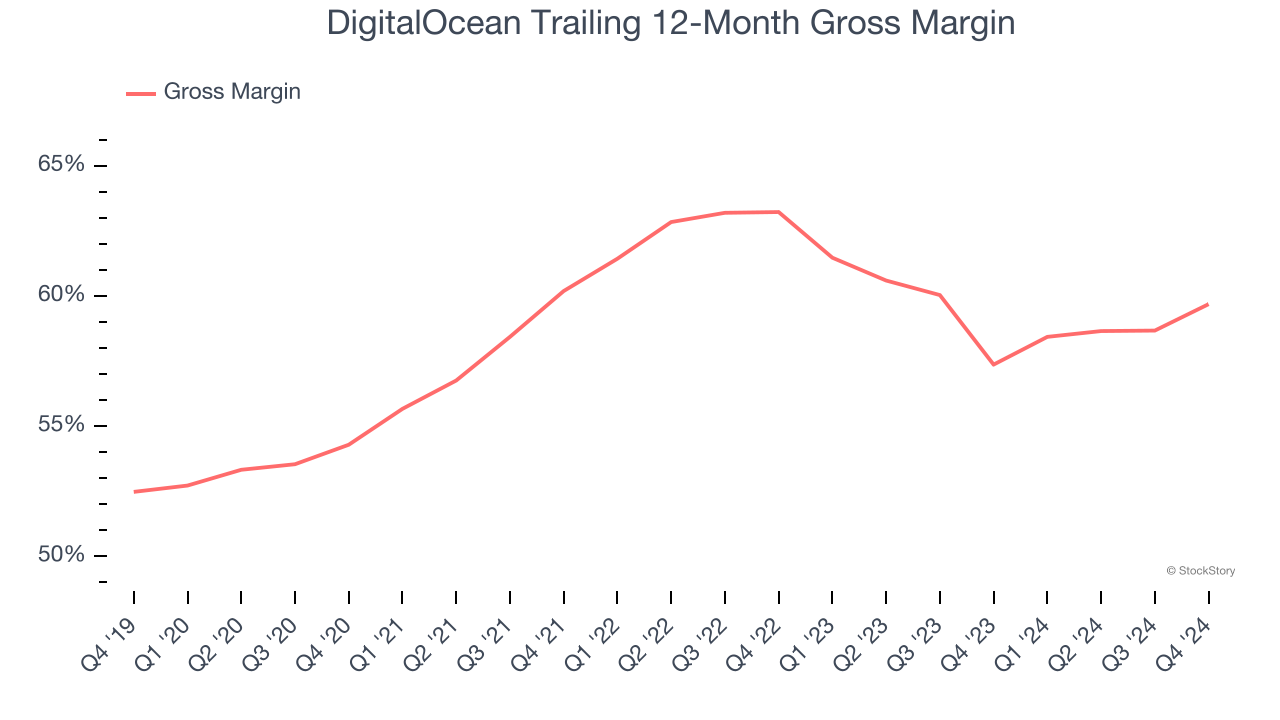

For software companies like DigitalOcean, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

DigitalOcean’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 59.7% gross margin over the last year. Said differently, DigitalOcean had to pay a chunky $40.31 to its service providers for every $100 in revenue.

Final Judgment

DigitalOcean isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 3.3× forward price-to-sales (or $30.61 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. We’d recommend looking at the Amazon and PayPal of Latin America.

Stocks We Would Buy Instead of DigitalOcean

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.