General Motors (GM) has spent the past several quarters reshaping the business: trimming EV ambitions, cutting costs, and leaning on strong pickup and SUV demand to shore up cash flow and margins as it pivots into 2026. After a solid fourth-quarter showing and updated 2026 guidance, the board approved a 20% dividend bump and authorized a $6 billion buyback alongside the results.

For income-focused investors, that dividend move reads well on the surface, but the bigger question for buy-or-sit-out decisions is whether GM’s cash generation and EV restructuring risks leave enough runway for sustainable yield and capital appreciation.

The questions remain: Does a 20% raise change the investment thesis for GM stock? Let's see.

About GM Stock

General Motors is America’s largest automaker, selling cars, trucks, and SUVs under the Chevrolet, GMC, Cadillac, and Buick brands. GM is known for its strong truck lineup and a broad range of vehicles, including the industry’s widest set of EVs.

GM has also been active on the technology front lately. It has partnered with Redwood Materials on energy storage, and GM batteries (new and second-life) will power grid-scale battery systems, targeting surging demand from AI data centers. More recently, at its “GM Forward” event, the company unveiled new tech: by next year, GM vehicles will include conversational AI Google (GOOG) (GOOGL) Gemini for in-car voice assistance, and starting this year, it will offer a full “GM Energy Home System” bi-directional EV charging plus home battery backup. These innovations show GM is pushing into AI-driven services and energy, not just cars. Also, it helps the company’s growth initiatives, which could boost its long-term value.

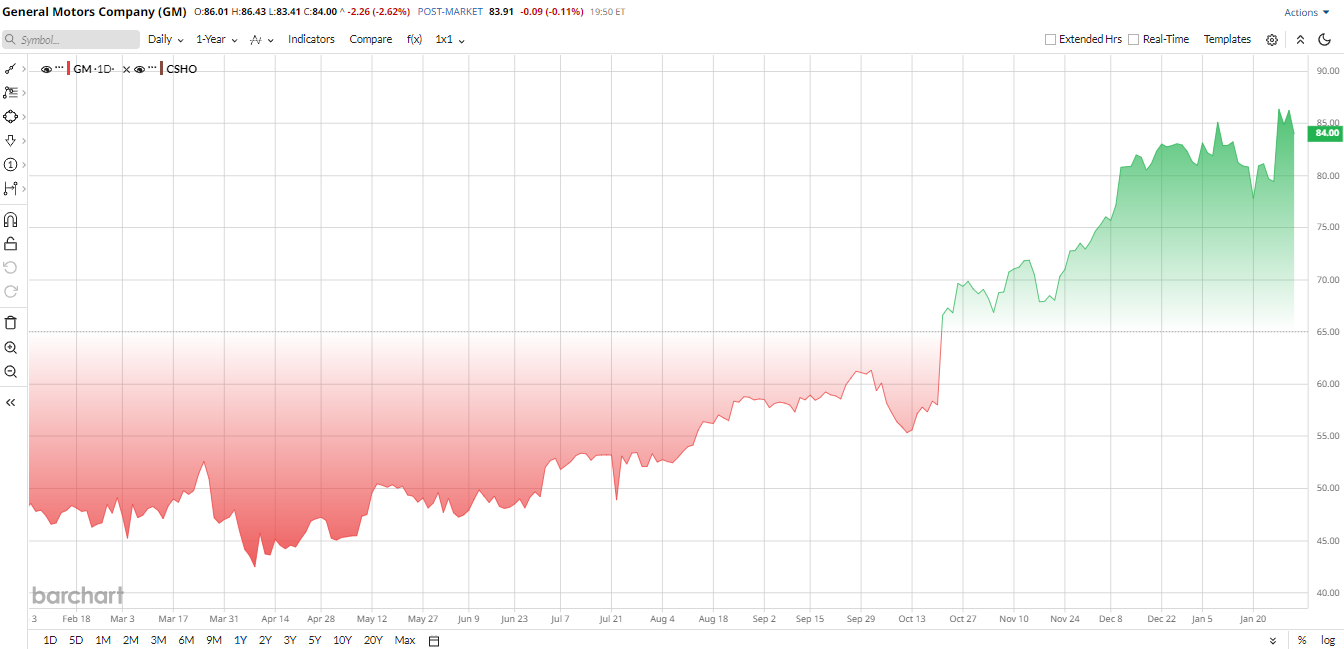

Valued at $76 billion by market cap, GM’s shares have soared in 2025. The stock jumped about 69% over the past year, far outpacing the broader market. This was driven by solid sales of high-margin trucks and SUVs and renewed investor confidence. In comparison. Shares have been hanging around the mid-$80s lately after the Q4 results, reflecting the market’s upbeat reaction.

Despite the bull run, GM now trades at very attractive price points. Its forward P/E ratio is only about 7×, roughly half the sector median of 17×, implying the stock is cheap compared to other peers.

Dividend Increase

GM’s board just declared a 20% bump in its quarterly payout to $0.18. Coupled with a fresh $6 billion buyback, which shows management’s solid confidence in cash flow. The 20% hike is a clear shareholder-friendly move. It modestly boosts yield to 0.85% and signals financial strength. The stock popped on the announcement, reversing some recent profit-taking.

Analysts note that such generous capital returns can support the stock price and draw income investors. Critics may argue GM should invest more in EVs or hold cash, but CEO Mary Barra and her team are emphasizing a balance of growth and returns. Overall, the dividend increase is viewed as a positive catalyst for the stock.

Fourth-Quarter Highlights

GM’s Q4 showed the kind of mixed-but-encouraging results that make income investors perk up: core operations are humming while one-time EV restructuring charges cloud the GAAP picture. Revenue slipped to $45.3 billion, about a 5% decline, but adjusted pre-tax profit climbed 13%, and adjusted EPS beat expectations at $2.51 vs. roughly $2.20. The major headline was a GAAP loss, roughly $3.3 billion, which came from $6 to 7 billion in restructuring tied to its EV reset, not the day-to-day business.

Look past the accounting noise, and the story is stronger, like full-year sales of roughly $185 billion, $12.7 billion of adjusted EBIT, and $10.6 billion of free cash flow in 2025.

As we look ahead, management's 2026 guide, which projects adjusted EBIT of $13 to 15 billion and EPS of $11 to 13, plus $21.7 billion in year-end cash, argues that the dividend hike and buybacks are affordable.

If we see this quarter overall, margins remain tight, and legacy costs are a drag, but prudent cost cuts, pricing power in North American trucks, and a smaller China loss make GM’s cash-return case convincing, assuming execution stays on track.

Analyst Commentary on GM Stock

Wall Street analysts have turned upbeat on GM stock lately. Morgan Stanley recently reiterated an “Overweight” and lifted its 12-month target to about $100, citing the strong earnings beat and shareholder actions.

Goldman Sachs likewise raised its fair value to roughly $104, noting that GM’s rich guidance and returns justify a higher price.

Lastly, RBC Capital moved its target to $107, pointing out that looming tariff relief (via USMCA) and disciplined execution could drive upside.

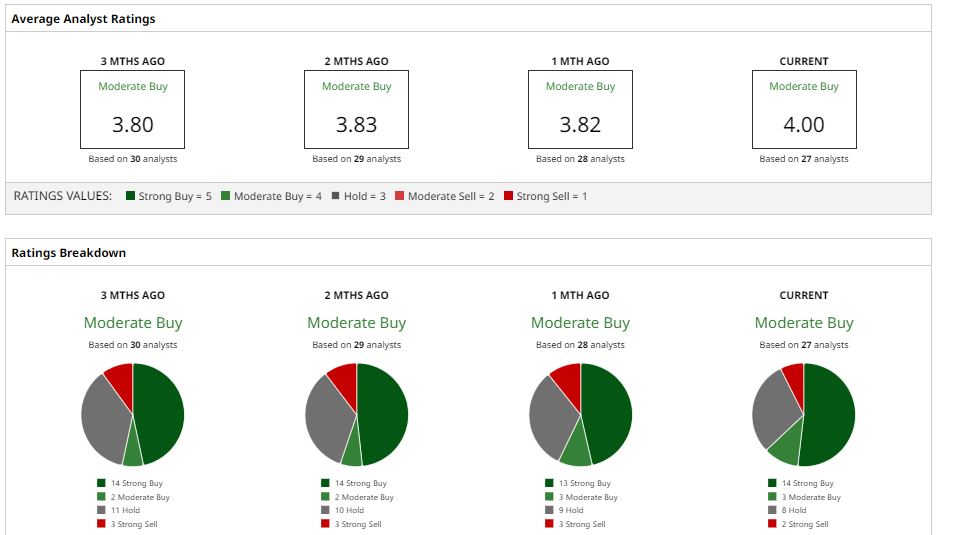

Also, the consensus rating is “Moderate Buy,” and the consensus target is now at $89.20, which implies the stock could climb nearly 6% over current levels. Analysts generally praise GM’s free cash flow and capital returns, which support these lofty price targets.

So taking all into account, it looks like GM’s dividend bump, buybacks, and cash flow make GM a compelling buy for income-focused investors.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart