Fifth Third Bancorp (FITB), based in Cincinnati, Ohio, runs a broad financial services operation. Through its Fifth Third Bank, it offers commercial and consumer banking, as well as wealth and investment advisory services, across 12 states. It maintains more than 1,000 branches, prioritizing local engagement and tech-driven banking. The company has a market capitalization of $33.20 billion.

Strong investor sentiment has propelled the stock to new heights. The stock has increased 17.2% over the past 52 weeks, while the broader S&P 500 index ($SPX) has gained 15.5%. Over the past six months, the outperformance has become even more pronounced: the stock is up 27%, while the index is up 11.8%. FITB’s shares reached a 52-week high of $53.33 on Jan. 22, but are down 2.6% from that level.

Compared with the company’s sector, we see similar outperformance: the State Street Financial Select Sector SPDR ETF (XLF) has been up 5% and 5.1% over the past 52 weeks and six months, respectively.

FITB’s shares popped 3.4% intraday on Feb. 2, as it closed its merger with Comerica, creating the ninth-largest bank in the U.S., with approximately $294 billion in assets. The company now operates in 17 of the 20 fastest-growing large markets, including key regions such as the Southeast, Texas, and California, and is expanding its business in the Midwest.

The merged entity now boasts two $1 billion recurring, high-return fee streams, delivering stable, varied income and greater reinvestment potential for expansion. Based on this, FITB plans to have about 1,750 branches, over half of which will be located in the Southeast, Texas, Arizona and California, by 2030.

After FITB reported strong returns in the fourth quarter of 2025, Wall Street analysts remain bullish about the company’s future earnings. For the current quarter, the company’s EPS is expected to climb by 19.2% year-over-year (YOY) to $0.87 on a diluted basis. For the current year, EPS is expected to grow by 11% YOY to $4.03.

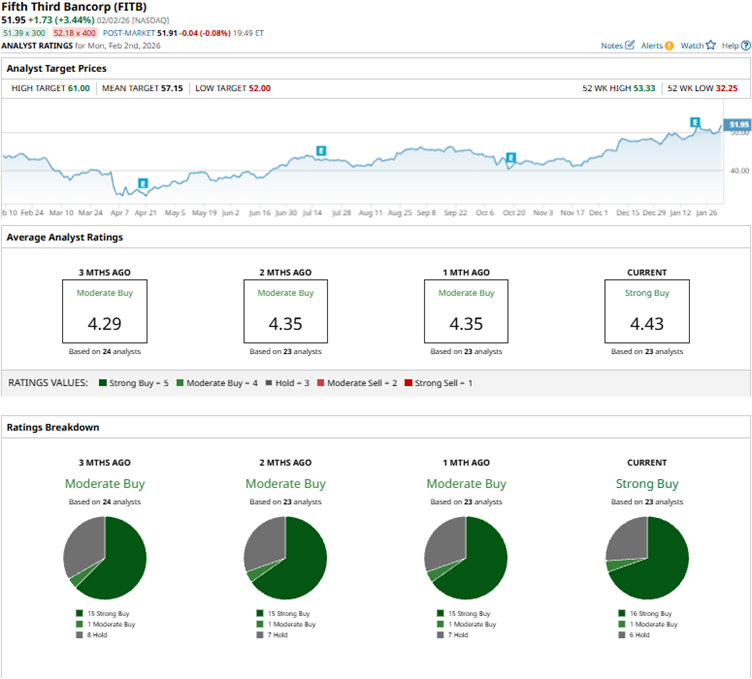

Among the 23 Wall Street analysts covering FITB’s stock, the consensus is a “Strong Buy.” That’s based on 16 “Strong Buy” ratings, one “Moderate Buy,” and six “Holds.” The ratings configuration has become more bullish than a month ago, with the overall rating changing from “Moderate Buy” to “Strong Buy” as the number of “Strong Buy” ratings increased from 15 to 16.

Post its Q4 earnings release, analysts at Truist Securities maintained a “Buy” rating on the stock, while raising the price target from $55 to $60. This increase in the price target reflects the company’s earlier-than-expected acquisition of Comerica and a higher tax rate outlook.

FITB’s mean price target of $57.15 indicates a 10% upside over current market prices. The Street-high price target of $61 implies a 17.4% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart