Novo Nordisk (NVO) shares crashed on Tuesday after the Danish drugmaker issued a sobering outlook for 2026 that caught Wall Street flat-footed.

According to the pharma giant, its top- and bottom-line growth will decelerate this year as its “Most Favored Nations” agreement with the U.S. lowers weight-loss drug prices in its largest market.

At the time of writing, Novo Nordisk stock is trading some 20% below its year-to-date high.

What This 2026 Outlook Really Means for Novo Nordisk Stock

While Novo Nordisk technically beat its rival Eli Lilly (LLY) to the punch with the U.S. launch of Wegovy, today’s update suggests that victory may prove hollow for investors in the near term.

On Feb. 3, Lars Fruergaard Jørgensen’s, the firm’s chief executive, insisted that he’s “encouraged by the promising early uptake” of its oral GLP-1 drug. However, the math isn’t adding up; at least for the current financial year.

Oral Wegovy was widely expected to be the ultimate catalyst for NVO stock, but management’s forecast of cooling growth suggests volume gains just can’t outrun eroding prices.

In short, the multinational’s full-year guidance somewhat evaporates the incentive to stick with its shares, especially at the current, stretched valuation of more than 18x forward earnings.

Technicals and Options Data Warrant Selling NVO Shares

Novo Nordisk shares also remain unattractive to own in 2026 because the selloff on Feb. 3 pushed them decisively below their key moving averages (50-day, 100-day, 200-day).

This means bears are fully in control and the downward pressure may sustain, especially since the relative strength index (14-day) isn’t signaling oversold conditions at the time of writing either.

Moreover, NVO is bracing for the first wave of generic competition as its blockbuster semaglutide loses exclusivity in major international markets like China, Brazil, and Canada.

These fundamental and technical headwinds have options traders pricing in a continued decline in this pharma stock to about $43 by mid-April.

Wall Street Still Hasn’t Thrown in the Towel on Novo Nordisk

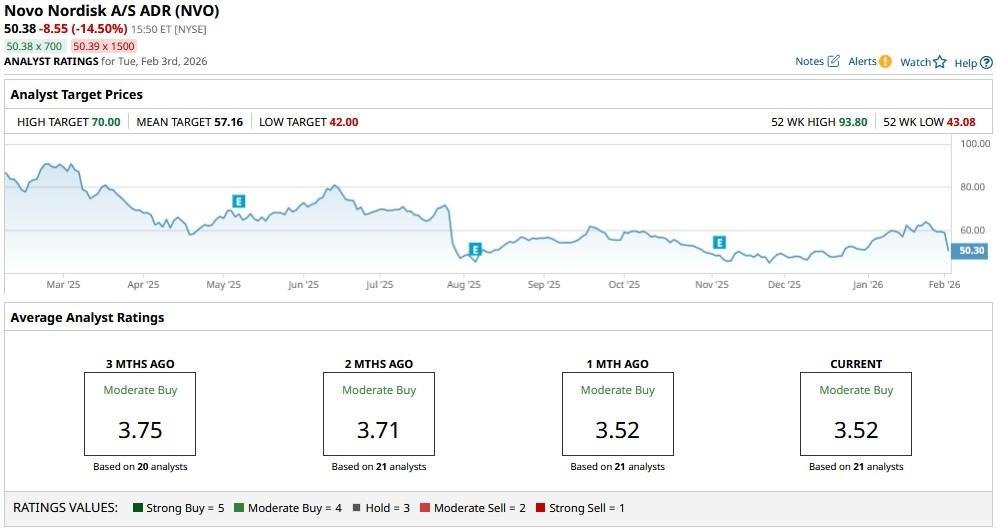

Wall Street analysts, however, seem to disagree with the options data, given the consensus rating on Novo Nordisk remains at a “Moderate Buy.”

The mean target of $57 suggests NVO shares could actually gain some 14% from current levels over the next 12 months.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Amazon Just Gave This Little-Known AI Stock a Huge Boost. Should You Buy Shares Now?

- As Novo Nordisk Stock Breaks Below Key Support Levels, Should You Buy the Dip?

- 4 Reasons To Buy the Dip in SoFi Stock Right Now

- PayPal Stock Is Now Deep in Oversold Territory. Should You Buy the Dip After 8-Day Losing Streak?