Bellevue, Washington-based T-Mobile US, Inc. (TMUS) provides mobile communications services. Valued at $220.6 billion by market cap, the company offers wireless voice, messaging, and data services.

Shares of this leading telco operator have underperformed the broader market over the past year. TMUS has declined 16.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 15.5%. In 2026, TMUS stock is down 4%, compared to the SPX’s 1.9% rise on a YTD basis.

Narrowing the focus, TMUS’ underperformance is also apparent compared to iShares U.S. Telecommunications ETF (IYZ). The exchange-traded fund has gained about 31.6% over the past year. Moreover, the ETF’s 6.6% gains on a YTD basis outshine the stock’s losses over the same time frame.

TMUS is struggling due to a combo of high expectations, tough competition in key markets, and rising capital expenditures. These factors are squeezing margins and impacting performance.

For the current fiscal year, ended in December 2025, analysts expect TMUS’ EPS to grow 3.5% to $10 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

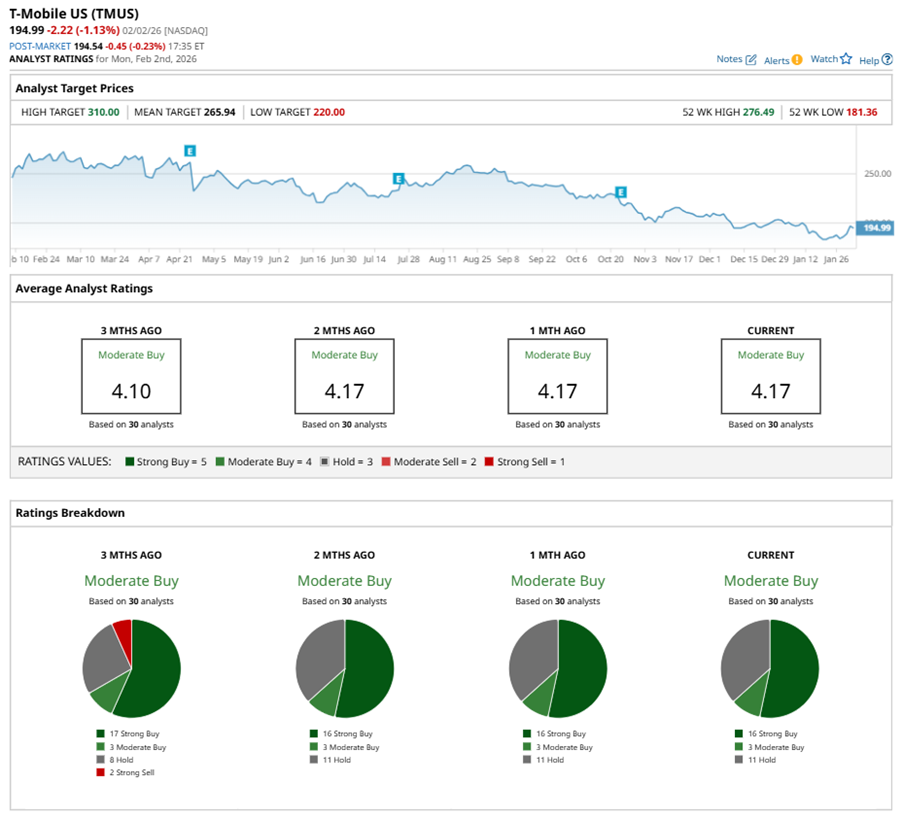

Among the 30 analysts covering TMUS stock, the consensus is a “Moderate Buy.” That’s based on 16 “Strong Buy” ratings, three “Moderate Buys,” and 11 “Holds.”

This configuration is less bearish than three months ago, with 17 analysts suggesting a “Strong Buy,” and two advising a “Strong Sell.”

On Jan. 26, Wells Fargo & Company (WFC) kept an “Overweight” rating on TMUS and lowered the price target to $225, implying a potential upside of 15.4% from current levels.

The mean price target of $265.94 represents a 36.4% premium to TMUS’ current price levels. The Street-high price target of $310 suggests an ambitious upside potential of 59%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- After the Silver Futures Price Crash, This Technical Demand Zone Marks the Next Buy Opportunity

- Nio Just Broke Below Its 20-Day Moving Average Despite Nearly Doubled Deliveries. How Should You Play NIO Stock Here?

- 1 Promising Stock That Just Hit New 52-Week Highs

- Dear AMD Stock Fans, Mark Your Calendars for February 3